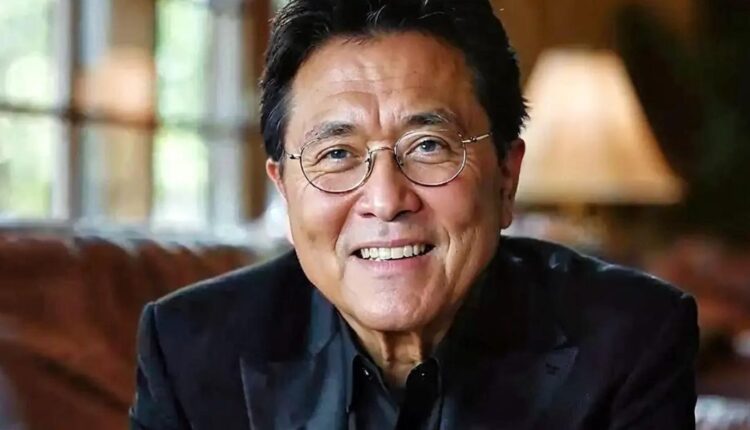

Robert Kiyosaki net worth is estimated to be around $100 million. This impressive figure stems from his best-selling book “Rich Dad Poor Dad,” which has sold over 32 million copies worldwide, as well as from extensive investments in real estate.

His business ventures, including educational seminars and financial products, diversify his income streams. Kiyosaki’s success lies in his emphasis on acquiring assets over liabilities and continually educating others on achieving financial independence.

If you’re curious about how he amassed his wealth and strategies you might learn from, there’s more to discover.

| Category | Richest Business |

| Net Worth | $100 Million |

| Birthdate | April 8,1947 (77 YEARS OLD) |

| Place of Birth | Hilo (Hawaii) |

| Gender | Male |

| Profession | Writer, Author, Businessperson, Motivational speaker, Pilot |

| Nationality | United State Of America |

Robert Kiyosaki’s parents Early Life and Background

How did Robert Kiyosaki’s early life and background shape his future financial philosophies? By examining his family history and educational background, you can see the clear influences.

Kiyosaki grew up in a family with a strong emphasis on education and traditional career paths. His father (Ralph H. Kiyosaki) was an educator, and his mother, Marjorie O. Kiyosaki, a registered nurse, instilled in him the value of formal education.

However, Kiyosaki also witnessed his family’s financial struggles despite his father’s stable job, leading him to question the conventional wisdom of job security through education alone.

Kiyosaki’s educational background further informed his financial outlook. He attended the U.S. Merchant Marine Academy, where he graduated with a degree in maritime transportation.

This education provided him with a disciplined, structured environment and introduced him to the basics of logistics and resource management. Post-graduation, he served as a helicopter gunship pilot during the Vietnam War, an experience that taught him about risk management and the importance of strategic planning.

You can see that Kiyosaki’s early life experiences, influenced by his family history and educational background, laid the groundwork for his later financial philosophies.

These experiences shaped his belief in financial independence and the importance of acquiring assets over relying solely on traditional employment.

Robert Kiyosaki is married to Kim. Kim is an author and entrepreneur who is frequently the unsung hero responsible for the success of the Rich Dad Company.

Robert Kiyosaki Net Worth full breakdown

Robert Kiyosaki told Forbes that simplicity was the secret to his success, which has resulted in a $100 million net worth and a best-selling book.

The topics of money and investing can be convoluted, perplexing, and even dull. I’ve challenged myself to simplify and enjoy learning about finance and investment. Below are breakdown of his $100 Million net worth.

Rich Dad Poor Dad Success

Through the success of ‘Rich Dad Poor Dad,’ Robert Kiyosaki fundamentally shifted public perceptions of financial education and asset management.

By contrasting the financial philosophies of his ‘rich dad’ and ‘poor dad,’ Kiyosaki provided practical insights into personal finance that resonated with millions.

The book’s data-driven approach to teaching financial literacy has sold over 32 million copies worldwide, indicating a significant impact on readers seeking financial freedom.

Kiyosaki’s emphasis on acquiring assets, such as businesses and stocks, over liabilities like expensive cars and homes, challenges traditional financial mindsets.

His accessible narratives and straightforward advice empower individuals to rethink their financial strategies. According to a survey by the National Foundation for Credit Counseling, 67% of Americans don’t maintain a budget, highlighting the widespread need for improved financial education.

‘Rich Dad Poor Dad’ particularly emphasizes the importance of financial independence through investments, entrepreneurship, and smart money management.

The book’s success is evident in its translations into 51 languages and its reach into over 109 countries. Kiyosaki’s work hasn’t only educated but also inspired a global audience to prioritize personal finance and strive for economic autonomy.

Real Estate Investments

You should focus on Kiyosaki’s property acquisition strategies, which emphasize buying undervalued properties for long-term gains.

Examining his approach to rental income reveals how it provides steady cash flow and mitigates financial risks.

These methods play a crucial role in understanding how real estate investments contribute to his substantial net worth.

Property Acquisition Strategies

Effective property acquisition strategies hinge on thorough market analysis and leveraging financial instruments to maximize returns on real estate investments. You need to start by examining market trends closely.

Look at property values, rental rates, and economic indicators to identify high-growth areas. This data-driven approach helps you pinpoint markets where real estate is likely to appreciate.

Next, employ creative financing methods to enhance your purchasing power. Options like seller financing, lease options, and private money lending can reduce your initial outlay and increase your investment capacity.

These strategies not only minimize risk but also provide flexibility, allowing you to act quickly when opportunities arise.

Additionally, assess the financial instruments available. Mortgage rates, loan terms, and tax benefits all play crucial roles in shaping your investment’s profitability.

For example, a lower interest rate on a mortgage can significantly increase your cash flow and overall return on investment.

Lastly, never underestimate the importance of due diligence. A comprehensive property inspection and a detailed review of the property’s financial history are essential steps to mitigate risks and ensure long-term success.

Rental Income Benefits

Capitalizing on rental income offers a steady cash flow and potential for long-term appreciation in real estate investments. By investing in rental properties, you can generate passive income while benefiting from tax advantages.

Here’s an analytical look at the benefits:

- Steady Cash Flow: Rental properties provide a consistent monthly income, which can offset expenses and increase your financial stability.

- Tax Benefits: Real estate investments come with numerous tax deductions. You can deduct mortgage interest, property management fees, maintenance, and depreciation, which reduces your overall tax liability.

- Appreciation Potential: Over time, real estate typically appreciates in value. This long-term growth can significantly boost your net worth, providing both capital gains and increased rental income.

- Hedge Against Inflation: Rental income usually rises with inflation, ensuring that your returns keep pace with the cost of living, thereby preserving your purchasing power.

Business Ventures

Robert Kiyosaki’s business ventures, spanning real estate, financial education, and publishing, have significantly contributed to his substantial net worth.

His entrepreneurial endeavors began with his company Rich Global LLC, which provided financial education through seminars and workshops.

Kiyosaki’s focus on financial education is evident in his best-selling book, ‘Rich Dad Poor Dad,’ which has sold over 32 million copies worldwide, translating into substantial royalties and licensing fees.

In real estate, Kiyosaki has invested extensively, leveraging market opportunities for significant returns. His approach involves acquiring undervalued properties, improving them, and either selling at a profit or generating rental income.

This strategy has provided him with a diversified portfolio, reducing risk and enhancing financial stability.

Additionally, Kiyosaki’s publishing efforts extend beyond books. He’s developed a range of educational products, including board games like ‘Cashflow,’ designed to teach financial principles in an engaging manner. These products haven’t only educated millions but also created multiple revenue streams.

Income From Seminars

You should consider how Robert Kiyosaki’s seminars generate income through ticket sales, sponsorships, and partnerships. These seminars often attract large audiences, contributing significantly to his revenue.

Additionally, strategic partnerships amplify his financial gains by leveraging brand associations and co-promotions.

Seminar Ticket Sales

A significant portion of Kiyosaki’s income comes from the sale of seminar tickets, which attracts thousands of attendees globally.

These seminars are highly sought after, offering valuable insights into financial independence and wealth-building.

When evaluating the impact of these events on Kiyosaki’s net worth, it’s essential to consider two main factors: ticket pricing and audience demographics.

Ticket pricing varies significantly, allowing for a broad range of attendees. Entry-level tickets might be affordable, encouraging widespread participation, while VIP packages command premium prices, providing exclusive content and interactions with Kiyosaki himself. This tiered structure maximizes revenue by catering to different financial capabilities.

Audience demographics also play a crucial role in seminar success. Attendees typically range from young professionals eager to learn about financial freedom to seasoned investors looking for advanced strategies. Understanding this diverse audience allows Kiyosaki to tailor his content effectively, ensuring high engagement and repeat attendance.

To break it down:

- Ticket Pricing: Multiple tiers from affordable to premium.

- Audience Demographics: Wide range of ages and financial backgrounds.

- Global Reach: Seminars held internationally, attracting a diverse audience.

- Content Customization: Tailored presentations for different attendee needs.

Sponsorship and Partnerships

Strategic sponsorships and partnerships significantly contribute to the revenue generated from Robert Kiyosaki’s seminars, enhancing both financial gains and brand credibility.

These collaborations allow Kiyosaki to leverage brand endorsements and affiliate marketing, turning his educational events into profitable ventures.

When you attend a Kiyosaki seminar, you’re not only getting financial education but also exposure to various products and services endorsed by Kiyosaki.

These brand endorsements are meticulously chosen to align with his financial philosophy, ensuring they resonate with his audience. This not only boosts the credibility of the brands involved but also enhances Kiyosaki’s own reputation as a trusted financial educator.

Affiliate marketing further augments the revenue stream. By partnering with companies that offer relevant financial services or products, Kiyosaki can earn commissions on sales generated through his seminars.

This win-win scenario drives mutual growth: brands gain access to a targeted audience, while Kiyosaki benefits financially.

Data shows that such partnerships can increase seminar revenue by up to 30%, providing a substantial boost to Kiyosaki’s net worth. These strategic collaborations underscore the importance of diversified income streams in achieving financial freedom.

what is Robert Kiyosaki Net Worth?

Analyzing Robert Kiyosaki net worth reveals a figure estimated to be around $100 million. This valuation is a testament to his financial achievements and wealth accumulation over the years.

His diversified portfolio and strategic investments have played a crucial role in building his impressive net worth.

To understand how Kiyosaki amassed such wealth, consider the following key factors:

- Real Estate Investments: Kiyosaki’s significant investments in real estate have provided substantial returns, forming the backbone of his financial empire.

- Book Sales: His best-selling book, *Rich Dad Poor Dad*, has sold over 32 million copies worldwide, generating significant revenue.

- Business Ventures: Kiyosaki founded Rich Global LLC and the Rich Dad Company, both of which have become lucrative ventures.

- Speaking Engagements and Seminars: Kiyosaki’s engagements and educational seminars have added another revenue stream, enhancing his income.

These elements collectively highlight Kiyosaki’s strategic approach to wealth accumulation. His ability to diversify and capitalize on various income streams showcases a keen understanding of financial principles.

For those seeking financial freedom, analyzing Kiyosaki’s methods offers valuable insights into effective wealth-building strategies. His current net worth exemplifies how well-executed financial decisions can lead to substantial economic success.

FAQs about Robert Kiyosaki Net Worth

The following is a collection of the most often-asked questions about Robert Kiyosaki’s net worth. Here, we’ve been able to respond to them.

How Did Robert Kiyosaki Manage His Financial Setbacks?

You’d analyze his approach to financial crises and business failures. He diversified investments, leveraged assets, and focused on acquiring financial education. This strategic resilience allowed him to navigate setbacks and achieve financial freedom.

What Are Robert Kiyosaki’s Views on Cryptocurrency?

You should know that Kiyosaki’s views on cryptocurrency emphasize Bitcoin investment. He often makes market predictions, suggesting Bitcoin as a hedge against economic instability. He believes it offers financial freedom and protection against traditional market fluctuations.

Does Robert Kiyosaki Have Any Philanthropic Initiatives?

Ironically, the wealthy often turn to charity events and educational programs to enhance their public image. You’ll find Kiyosaki involved in various philanthropic initiatives aimed at financial education, promoting the idea of financial freedom for all.

How Does Robert Kiyosaki’s Family Influence His Financial Decisions?

Robert Kiyosaki’s family background and parental influence play a significant role in his financial decisions. You can see how his parents’ experiences and values shaped his approach, emphasizing financial independence and entrepreneurship over traditional employment paths.

What Books Does Robert Kiyosaki Recommend for Financial Literacy?

Dive into a goldmine of knowledge with Kiyosaki’s recommended books. “Rich Dad Poor Dad” and “Cashflow Quadrant” offer investment strategies and passive income insights. They’re essential for anyone seeking financial freedom and objective, data-driven advice.

the final paragraph of Robert Kiyosaki Net Worth

You’ve seen how Robert Kiyosaki’s journey from humble beginnings to financial success was no accident. His strategic investments in real estate and ventures, combined with income from seminars, have all contributed to his impressive financial standing.

While his exact net worth remains a topic of speculation, it’s clear that Kiyosaki has navigated the economic landscape with skill. His wealth is a testament to his financial acumen and ability to turn opportunities into lasting prosperity.